Banking & Financial Services

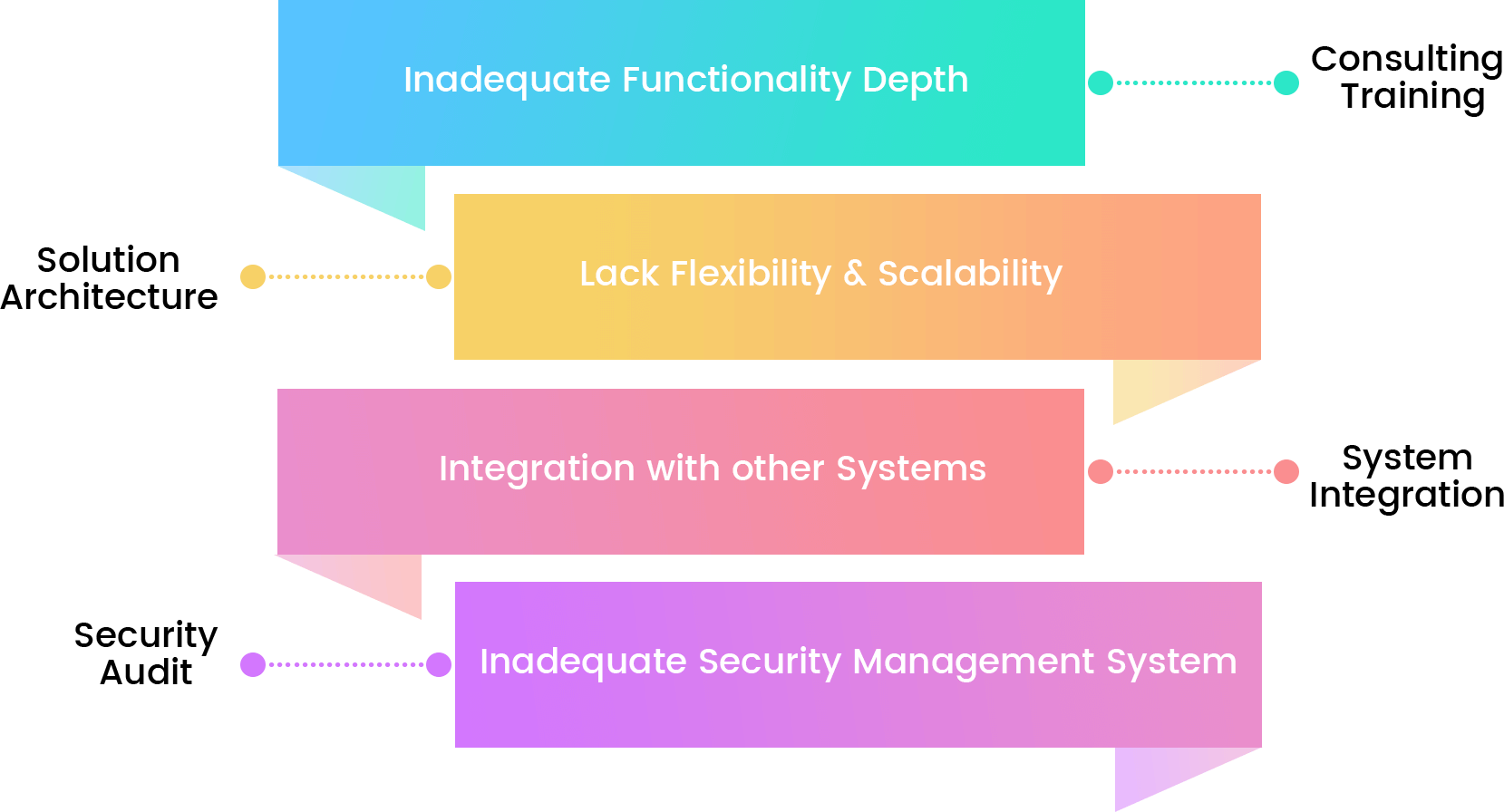

Digital Transformation is proclaiming major changes in the banking industry. Coordinate client interaction through a multitude of channels implies that banks must genuinely know their clients and benefit them safely. However, many established banks need the time and budget to form the kinds of inventive changes they got to compete in this modern commercial center. With the rapid changes in the digital world has a major impact on banking, financial institutions.

Banks are confronting competition from non-Banking players such as Google, PayPal, retailers, telecom suppliers and more. This slant is likely to extend in scope and intensity. These quick-changing patterns make huge challenges for Banks to hold their market position and client base.

BFSI sectors confront challenges in the understanding of their organization, intermediation and risk administration in a dynamic market characterized by rapid change in financial and organizational. The emergency and its difficulty were not one or the other unusual nor unavoidable since a few of the enterprises, by institutionalizing domain information and history of past emergency, effectively maintained a strategic distance from the pitfalls experienced by the failing organizations.

Digitally-Enabled Operations

Drive the process enhancement, cost savings, and faster services by connecting the employees, customers, and process.

Allied Workforce

Enable, Empowering and engaging the most valuable asset—people.

Engaging Customer Experience

Delight the client in an end-to-end involvement that captures the creative ability, whereas expanding reliability and income per client.